Following a downgrading of Sri Lanka’s sovereign credit to ‘-B’, Fitch warns that Sri Lanka’s GDP will contract 1.3 per cent in 2020 and has stated that bad loans will continue to increase from the reported 5.1 per cent stated for the first quarter of 2020.

Following a downgrading of Sri Lanka’s sovereign credit to ‘-B’, Fitch warns that Sri Lanka’s GDP will contract 1.3 per cent in 2020 and has stated that bad loans will continue to increase from the reported 5.1 per cent stated for the first quarter of 2020.

Commenting on their rating, Fitch stated that;

“There is a strong link between the sovereign credit profile and the operating conditions for banks in Sri Lanka”.

Fitch further remarked that as Sri Lanka’s GDP contracts, the growth of banks will be constrained as will recovery prospects. They also stated that the “increased risk of sovereign debt distress will limit banks’ access to and cost of foreign funding.”

Sri Lanka’s record on the economy

During the first quarter of 2020, Sri Lanka saw a strong economic growth rate of 5.1 per cent however due to the shock of the coronavirus, Fitch has stated that expected credit will be “muted”.

Reflecting on the stakeholders who are at risk, Fitch states:

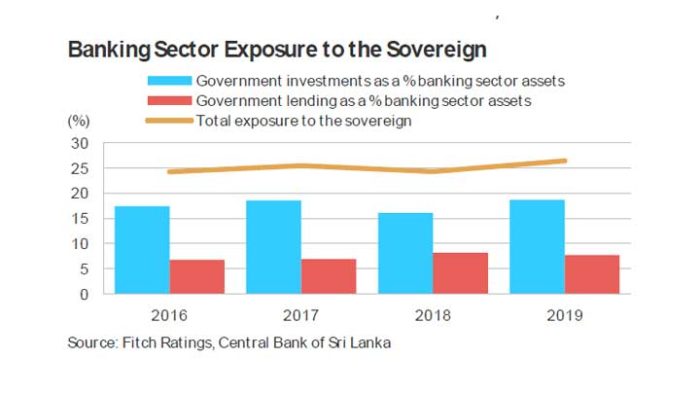

“Sri Lankan commercial banks also have significant exposure to the state mostly through investments in government securities”.

“[Sri Lanka’s] total exposure was over 25 per cent at end-2019. This underscores our view that it is unlikely that a domestic bank would be rated above the sovereign rating”, Fitch stated.

Economy Next reports that “high exposure to bonds will generate capital gains amid falling rates”.

Fitch has also specified that Sri Lanka’s economy is particularly vulnerable to negative shocks “after having previously experienced significant volatility in economic variables, such as interest rates and exchange rates in times of stress.”

For the past five years, Sri Lanka’s economic growth has been below the median for ‘B’ rated countries and credit growth has been slow.

A downward spiral

Fitch warns that as “sovereign credit profile deteriorates further, the operating environment will also worsen, including weakening of public- and private-sector balance sheets, funding market dislocations and macroeconomic volatility.”

Sri Lanka has responded to these by decrying these negative economic reports as “illogical”.

Read more from Economy Next.

We need your support

Sri Lanka is one of the most dangerous places in the world to be a journalist. Tamil journalists are particularly at threat, with at least 41 media workers known to have been killed by the Sri Lankan state or its paramilitaries during and after the armed conflict.

Despite the risks, our team on the ground remain committed to providing detailed and accurate reporting of developments in the Tamil homeland, across the island and around the world, as well as providing expert analysis and insight from the Tamil point of view

We need your support in keeping our journalism going. Support our work today.

For more ways to donate visit https://donate.tamilguardian.com.