Source: Bloomberg

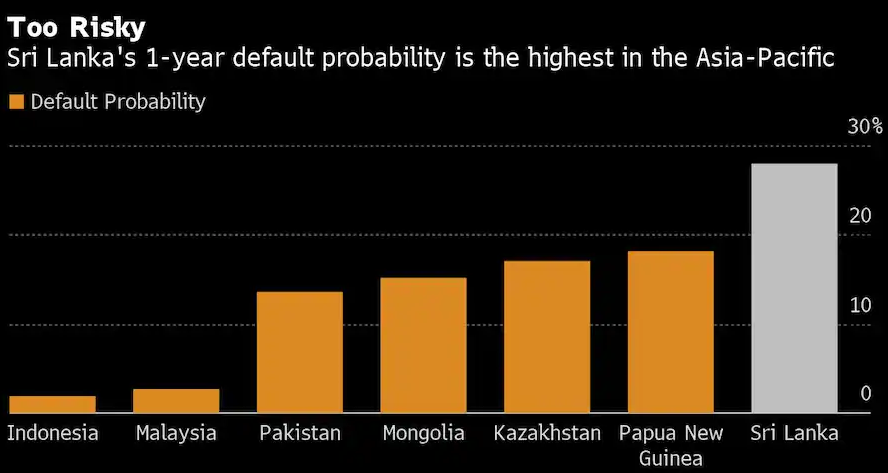

According to a Bloomberg model, Sri Lanka’s default probability was the highest in Asia with the organisation estimating a 27.9% chance of one-year default.

This is an increase of approximately 13% from six months ago with country’s five-year credit default rising to 1,553 basis points last week, the highest since the beginning of March. The Washington Post notes that “a reading above 1.5% signifies high risk of failure to pay”.

They further note that Sri Lanka’s “first test comes July 27, when the South Asian nation must repay a $1 billion bond to investors”. Sri Lanka owes at least $2.5 billion in debt over the next 12 months.

At the start of this month, Sri Lankan Prime Minister Mahinda Rajapaksa issued a special gazette to restrict the flow of foreign currency out of the country. The gazette has suspended remittances from Sri Lankan assets and funds granted to emigrants under the Migration Allowance. It also limits the repatriation of emigrant funds to a maximum of US $ 10,000 or its equivalent, while the general immigration allowance for migrants is limited to a maximum of US $ 30,000 or the equivalent at the relevant time.

The Washington Post notes concern from investors over Sri Lanka’s capital controls, “which are seen as a way for the economy to shun reliance on foreign borrowing, and more importantly ward off interference from the IMF, whose aid comes with strict conditions”.

The decision comes in advance of the European Union’s Council review of Sri Lanka’s GSP+ agreement in November and follows a resolution passed by the EU parliament condemning the deterioration of human rights in the island.

Read more here.