ICRA Lanka, a credit rating agency and a subsidiary of Moody's Investors Service, has downgraded its GDP growth projection for Sri Lanka to 3.4% and for state revenue to weaken to 9.1% of the GDP as the country struggles in response to a third wave of the pandemic.

The report further warns that Sri Lanka’s trade would continue to deteriorate despite import restrictions due to rising commodity prices. The ICRA notes:

“We expect the trade deficit to widen to $ 8 billion, current account balance to reach $ 1.4 billion, and gross official reserves would fall to $ 3.8 billion by the end of 2021”.

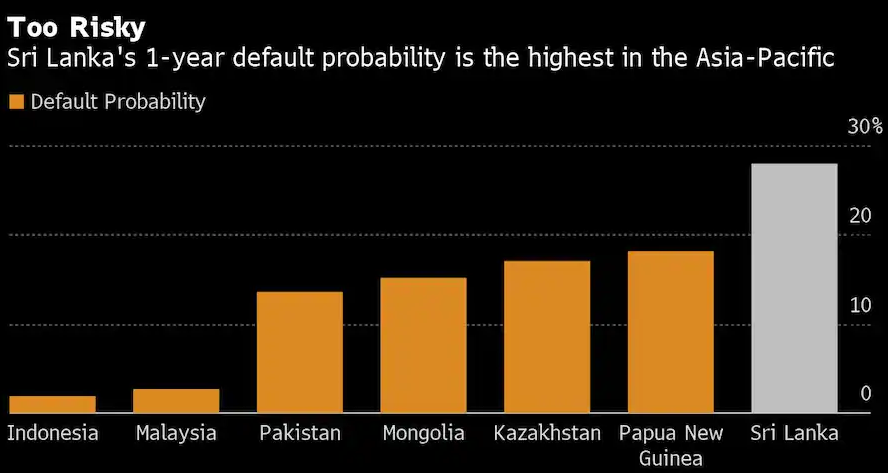

This reporting comes as investing agencies such as Bloomberg, Moody and Fitch have issued warnings on Sri Lanka which may cut the island “off from international capital markets”.

Deshal de Mel of Verité Research, a think-tank in Colombo, highlights that the country’s dwindling reserves “are now down to less than three months’ worth of imports”. According to a Bloomberg model, Sri Lanka’s default probability was the highest in Asia with the organisation estimating a 27.9% chance of one-year default.

Whilst Sri Lanka could turn to the International Monetary Fund for an assistance programme to restore confidence with investors; the country has instead chosen to pivot towards China, reports the Economist.

Read more here.