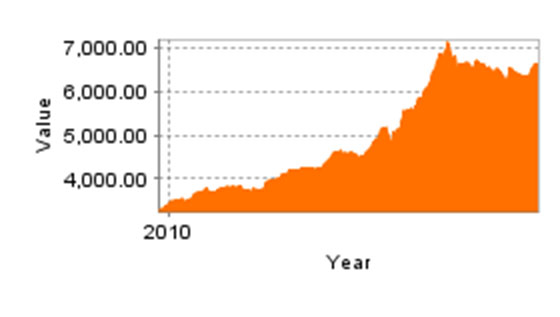

The doubling of Sri Lanka’s main stock market index in 2010 has led to some effusive news reports, most recently in The Guardian. Inevitably, these reports have been lauded in Sri Lanka’s state-owned press, alongside its own hype.

But, as other recent analysis shows, these reports make two mistaken assumptions: [1] that the index’s rise is entirely due to fundamental improvement in the stocks, and [2] that the market is indicative of the wider economy’s progress.

Firstly, the index has been driven up by Sri Lankan government buying, while foreigners are exiting. Secondly, the Colombo bourse is unrepresentative of the wider economy.

This is what the Sri Lankan Sunday Times’ economic column warned last October about the mistaken presumption:

“There is little doubt that the recent [stock] market performance is not directly related to either economic performance or market fundamentals. It has been guided by market sentiments, speculation and government intervention.”

See also this discussion in October by LBO of over-valuation and government buying.

In fact, international equity investors’ wariness of the Sri Lankan market is underlined by one detail:

Foreigners have been net sellers in 2010 and 2009 – after having been net buyers since 2001 (See Reuters’ reports in Dec and Feb 2010).

2010 saw a net foreign outflow of US$240m (Rs 26.4bn), more than twice 2009’s outflow of US$103m (Rs 11.4bn).

Below are further extracts of the Sunday Times' analysis:

Why the stock market and economy are not connected:

“There is a tendency to think that the performance of the stock market is an indicator of the country’s economic performance. Most people, including foreign observers, draw a connection between the economy and the stock market and the stock market and the economy. … Yet that relationship is not as strong as it is made out to be. It is often a very tenuous connection, especially in an economy such as ours and in a rather narrow stock market like [Colombo’s].”

“Economic growth is based on a far broader economy than reflected in the share market. … For instance … domestic agriculture that is still important and contributes to growth … is outside the stock market. [In Sri Lanka] many economic enterprises are not listed in the stock exchange. … Even much of the industrial and trade sectors are outside the orbit of the stock market. For instance garment manufacturing firms are hardly in [it].”

“This is not so in developed countries like the United States where much of the economy is in the hands of companies listed in the stock exchanges of the country and internationally.”

Why the stock market has risen:

“It is because of this presumed relationship [between the stock market and the economy] that the government has directed government agencies such as the EPF (Employees' Provident Fund) and ETF (Employees' Trust Fund), state banks and other government controlled institutions to invest in the stock market.”

The question:

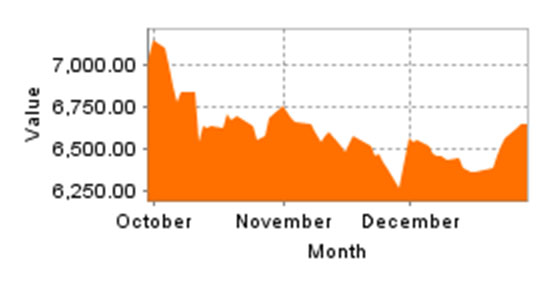

“Those who believe that the rise in the share market was due to the healthy economic fundamentals and prospects for growth may be hard hit to explain why the market that soared to over 7000 points has now dipped. Is the economy in a down turn?”

Indeed, it is worth seeing how the market has behaved since October, especially after the Sri Lankan government unveiled its 'investor friendly' budget in mid November:

|

|

| Graphs generated from Colombo Stock Exchange database on Dec 31, 2010. |

We need your support

Sri Lanka is one of the most dangerous places in the world to be a journalist. Tamil journalists are particularly at threat, with at least 41 media workers known to have been killed by the Sri Lankan state or its paramilitaries during and after the armed conflict.

Despite the risks, our team on the ground remain committed to providing detailed and accurate reporting of developments in the Tamil homeland, across the island and around the world, as well as providing expert analysis and insight from the Tamil point of view

We need your support in keeping our journalism going. Support our work today.

For more ways to donate visit https://donate.tamilguardian.com.